Pension Fund Portfolio Term Paper

Introduction

This kind of a fund portfolio has objectives of giving pension services to customers on a long-term basis. The investment portfolio was built using a top-down approach. This kind of approach can be interpreted that the securities were derived after consideration of several factors. The considerations include policy changes in the US, movements of industry and the macroeconomic trend. Investors need to have a healthy compensation plan, therefore there are some activities that should be taken in to place. The allocation of fixed income securities and equity should be balanced in a way that they carry to about 45% of the investment portfolio (Pennacchi, George and Mahdi Rastad 2011, p. 221-245).

Read more about Term Paper writing help on Pension Fund Portfolio here!

Utilities in the program

There are various services that are provided to the public according to the project. For the services to be provided, there must be various resources that aid in provision of the services. The assets in the program act as resources to ensure that the desired services are offered to the people. Those that are involved in the program are expected to invest so that they receive their compensation later. Their investment act as resources to fund the program in its activities. The program cannot run without people investing in it. The resources that are used in the program other than the investments form part of the utilities. The stakeholders in the program are also part of the utilities as they are useful in the program in making decisions. The decisions made by stakeholders play a critical role regarding success of the program.

Top-down Approach

Macroeconomic Analysis

Macroeconomics has several components such as inflation, the rate of unemployment and GDP among others. In the US, GDP growth is estimated at around 2%-3% annually. There are reforms that could possibly bring uncertainties in this GDP growth. There are possibilities that the US economy will keep growing in reference to data history. In 2017, the inflation rate was at 2.2% while the unemployment rate was maintained at a natural rate.

Government policy

In this case, we consider the Trump policy that has several aspects. Federal tax is an aspect of Trump’s policy. Personal and corporate tax have an effect on the federal tax. The trump’s policy had objectives of lowering business tax by 20% from 35% to 15%. This policy to lower corporate tax has a benefit to businesses on the factor of investments. Foreign businesses will be encouraged to invest more as they will be having more capital. Immigration limit is also government policy. There was a restriction for immigration of refugees from seven Muslim countries as at 27/1/2017. This was to last for around 120 days. Those who were in the US without the legal documents were to be kicked out. They made up to 5% of the US workforce (Ghemawat, Pankaj 2017,p. 112-123)

Industry assessment

The equities in the industrial sector help to meet the requirement to have stable and sizeable returns. Industries in the US believed that they would continue performing well for more years after 2016 due to some reasons. Infrastructure investment was to increase $1 trillion according to president Trump. Businesses were also to be given special tax credits and this would help improve the industry sector. The defence industry would receive an increase in their budget thus it will be highly used. There are various agencies that are involved in the defence industry and they required more funds for their work and that was a reason for an increased budget.

Asset Allocation policy

Asset allocation aims at minimizing the exposure to risks and maximizes the shape ratio while earning the target return. The illustration below will show asset allocation for top 20 funds as per Willis Towers Watson pension and investment analysis in the year 2016. From the illustration, Asia-pacific funds were invested in fixed income on a higher percentage (58.1) and on the other hand, the North American Funds were invested in fixed income with a percentage of 46.8%. In addition, the illustration shows that Europe and other markets had an investment in fixed incomes of 46.9% and had 39.6% of equities. Europe and other markets have balance allocation between equities and fixed incomes. This makes them more appropriate for application to our pension fund portfolio. The macroeconomics and government policies discussed above are likely to negatively impact equities and positively impact fixed incomes. Therefore, our portfolio needs to hold a huge portion of fixed incomes.

There are various sectors that can describe the process of securities selection and that of building effective frontiers. The healthcare sector was used in this case. The expenditure of the US health care sector has been increasing for some time. It is approximated that over 15000 people turn to the age of 65 every day in the US. This means that there will be a high demand for health care services. There were policies to help this sector. The drug makers would receive a reduction in the tax rate. This reduces the cost of drugs used in the health sector making them affordable to almost everyone. The financial sector was also used for the case of security selection. The financial sector is believed to develop with time. There are factors that can lead to this development. The Federal Reserve has increased the interest rate therefore borrowing will be more expensive. Increase in interest rate also has an impact on the strength of a dollar and in turn, improves the financial industry. The cutting of the corporate tax in the trump policy has also helped in improving the financial industry.

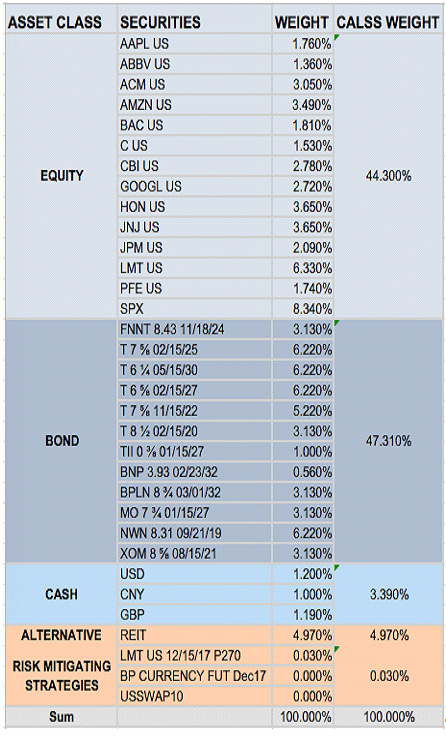

The figure below shows the overall WPC pension plan portfolio. It shows the different asset classes, securities, overall weight and weight for each class.

Performance and efficiency of portfolio

The overall annual return of the portfolio is 9.78 according to Bloomberg. The standard deviation is 4.53 and the Sharpe ratio is 2.09. The performance can be compared with that of benchmark and the annual return for our portfolio is better. According to Bloomberg, the total risk of our portfolio is 4.15 and the risk factor is 3.82. The non-risk factor is 1.64. The total risk is expressed in terms of standard deviation. The quantity of the potential loss can be measured using a statistical technique referred to as VaR (value at risk) (Rockafellar, R. Tyrrell, and Stanislav Uryasev 2002, p. 1443-1471). When there is historical data, portfolio profitability can be evaluated through a technique referred to as back-testing. The traders are in a position to understand the vulnerabilities of the strategy used in the portfolio through the use of back-testing. This vulnerability is connected to the real world situations. There is scenario analysis that is used in specific events for estimation of the expected portfolio market value (Postma, Theo JBM, and Franz Liebl 2005p. 161-173)

References

Ghemawat, Pankaj. “Globalization in the age of Trump.” Harvard Business Review 95.4 (2017): 112-123.

Pennacchi, George, and Mahdi Rastad. “Portfolio allocation for public pension funds.” Journal of Pension Economics & Finance 10.2 (2011): 221-245.

Postma, Theo JBM, and Franz Liebl. “How to improve scenario analysis as a strategic management tool?.” Technological Forecasting and Social Change 72.2 (2005): 161-173.

Rockafellar, R. Tyrrell, and Stanislav Uryasev. “Conditional value-at-risk for general loss distributions.” Journal of banking & finance 26.7 (2002): 1443-1471.